What are the three types of investment strategies?

There are many types of investments to choose from. Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds.

There are many types of investments to choose from. Perhaps the most common are stocks, bonds, real estate, and ETFs/mutual funds.

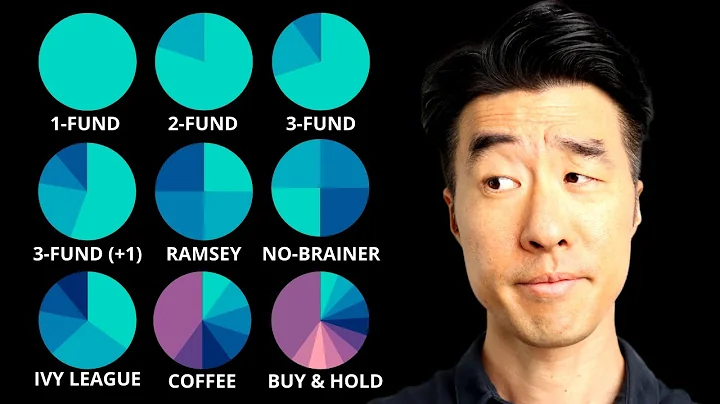

A three-fund portfolio is a portfolio which uses only basic asset classes — usually a domestic stock "total market" index fund, an international stock "total market" index fund and a bond "total market" index fund.

Active Investment Strategies. Passive Investment Strategies. High-Risk Investment Strategies. Low-Risk Investment Strategies.

An investment strategy can be either active or passive. An active strategy involves actively managing the portfolio, buying and selling assets in an attempt to outperform the market. A passive strategy, on the other hand, involves buying and holding a diversified portfolio of low-cost index funds that track the market.

Cryptoassets (also known as cryptos) Mini-bonds (sometimes called high interest return bonds) Land banking. Contracts for Difference (CFDs)

- The Rule of 72. This is not a short-term strategy, but it is tried and true. ...

- Investing in Options. Options offer high rewards for investors trying to time the market. ...

- Initial Public Offerings. ...

- Venture Capital. ...

- Foreign Emerging Markets. ...

- REITs. ...

- High-Yield Bonds. ...

- Currency Trading.

Level 1 assets are those that are liquid and easy to value based on publicly quoted market prices. Level 2 assets are harder to value and can only partially be taken from quoted market prices but they can be reasonably extrapolated based on quoted market prices. Level 3 assets are difficult to value.

The 3 Second Bitcoin Flip Trade is a fast trading strategy by Jeff Clark. It uses changes in Bitcoin prices to make quick profits without owning actual bitcoins. This strategy uses options trading, which bets on whether an asset's price will rise or fall.

| Portfolio Name | YTD Return | 10Y Return (Annualized) |

|---|---|---|

| Ray Dalio All Weather Portfolio | 0.48% | 5.20% |

| Simple Path to Wealth Portfolio | 5.16% | 9.52% |

| Bill Bernstein No Brainer Portfolio | 3.19% | 7.11% |

| Tech Stocks Dividend Portfolio | 4.34% | 16.02% |

What are the 2 major types of investing strategies?

- #1 – Passive and Active Strategies. ...

- #2 – Growth Investing (Short-Term and Long-Term Investments) ...

- #3 – Value Investing. ...

- #4 – Income Investing. ...

- #5 – Dividend Growth Investing. ...

- #6 – Contrarian Investing. ...

- #7 – Indexing.

Buy and hold

A buy-and-hold strategy is a classic that's proven itself over and over. With this strategy you do exactly what the name suggests: you buy an investment and then hold it indefinitely. Ideally, you'll never sell the investment, but you should look to own it for at least 3 to 5 years.

Buy-and-hold is a classic example of an investment strategy, ideal for long-term investors. Such investors believe in the "invest-and-hold" philosophy, allowing capital to steadily accumulate over time without frequent withdrawals.

Cash is the most liquid asset possible as it is already in the form of money. This includes physical cash, savings account balances, and checking account balances.

Buy and Hold

Buying and holding investments is perhaps the simplest strategy for achieving growth. If you have a long time to invest before needing your money, it can also be one of the most effective.

Backtest your investment strategy

When choosing our investment strategy, it is important to consider our risk tolerance, our expected return and the amount of effort we are willing to spend on managing our portfolio.

- Dividends. When companies are profitable, they can choose to distribute some of those earnings to shareholders by paying a dividend. ...

- Capital gains. Stocks are bought and sold constantly throughout each trading day, and their prices change all the time.

- High-yield savings accounts.

- Certificates of deposit (CDs)

- Bonds.

- Funds.

- Stocks.

- Alternative investments and cryptocurrencies.

- Real estate.

The U.S. stock market is considered to offer the highest investment returns over time. Higher returns, however, come with higher risk. Stock prices typically are more volatile than bond prices.

Which investments give the highest returns? Stocks provide the highest average annual returns: 13.8%, on average, compared to 1.6% on bonds, 0.8% on gold, 8.8% on real estate and 0.38% on CDs, according to Fidelity.

What is the first step to wise investment practices?

The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional.

- Certificates of deposit (CDs) and share certificates.

- Money market accounts.

- Treasury securities.

- Series I bonds.

- Municipal bonds.

- Corporate bonds.

- Money market funds.

- Dividend stocks.

Gross stage 3 assets in non-banking finance companies (NBFC) are loans which have been overdue for more than 90 days. As NBFC follow Indian Accounting Standards (Ind AS), they have to classify bad loans in three categories or stages.

Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the related assets or liabilities. Level 3 assets and liabilities include those whose value is determined using market standard valuation techniques described above.

A loan may be considered both an asset and a liability (debt). When you initially take out a loan and it is received by you in cash, it becomes an asset, but it simultaneously becomes a debt on your balance sheet because you have to pay it back.

References

- https://www.etf.com/sections/features/what-is-anti-esg-etf

- https://doublethedonation.com/how-csr-impacts-businesses/

- https://saylordotorg.github.io/text_the-business-ethics-workshop/s17-02-three-theories-of-corporate-so.html

- https://www.investopedia.com/news/history-impact-investing/

- https://link.springer.com/10.1007/978-0-387-93996-4_617

- https://www.fca.org.uk/investsmart/understanding-high-risk-investments

- https://www.vintti.com/blog/corporate-social-responsibility-csr-in-finance-finance-explained/

- https://www.sec.gov/Archives/edgar/data/898174/000089817420000005/R17.htm

- https://www.cisl.cam.ac.uk/business-action/sustainable-finance/investment-leaders-group/what-is-responsible-investment

- https://www.business.com/articles/can-you-make-a-profit-and-be-socially-responsible/

- https://www.bloomberg.com/news/articles/2024-01-09/esg-campaigns-seen-falling-out-of-favor-with-activist-investors

- https://www.chegg.com/homework-help/questions-and-answers/following-two-popular-forms-esg-investing-terms-assets-allocated-2018-2020-norms-based-scr-q112560616

- https://www.investopedia.com/terms/s/sri.asp

- https://www.s3solutions.co.uk/post/how-to-conduct-successful-social-investment

- https://www.wallstreetmojo.com/investment-strategies/

- https://www.nasdaq.com/articles/what-is-a-good-investment

- https://www.msd.govt.nz/documents/about-msd-and-our-work/publications-resources/corporate/bims/final-version-social-investment-bim-07-02-2017.pdf

- https://www.tsinetwork.ca/tag/successful-investment/

- https://www.carboncollective.co/sustainable-investing/socially-responsible-fund

- https://www.fool.com/investing/how-to-invest/stocks/investment-strategies/

- https://www.spglobal.com/en/research-insights/articles/what-is-the-difference-between-esg-investing-and-socially-responsible-investing

- https://www.fidelity.com/viewpoints/investing-ideas/3-keys-the-foundation-of-investing

- https://fortune.com/recommends/investing/safe-investments/

- https://www.financestrategists.com/wealth-management/investment-management/investment-strategy/

- https://www.rbcwealthmanagement.com/en-eu/insights/does-socially-responsible-investing-hurt-investment-returns

- https://www.intereconomics.eu/contents/year/2022/number/1/article/a-golden-rule-for-social-investments-how-to-do-it.html

- https://www.investopedia.com/financial-advisor/esg-sri-impact-investing-explaining-difference-clients/

- https://www.investopedia.com/financial-edge/0410/6-investment-styles-which-fits-you.aspx

- https://en.wikipedia.org/wiki/Social_investment_theory

- https://www.diligent.com/resources/blog/what-is-the-relationship-between-corporate-governance-sustainability

- https://www.sciencedirect.com/science/article/pii/S0148296320308237

- https://www.gobankingrates.com/investing/strategy/safe-investments-with-high-returns/

- https://blog.submittable.com/csr-strategy/

- https://www.linkedin.com/pulse/importance-corporate-social-responsibility-creating-impact-magazine

- https://rcs.co.za/media/assets-vs-debt-what-is-the-difference/

- https://emeritus.org/blog/importance-of-corporate-social-responsibility/

- https://www.coursehero.com/file/p76lk4ks/1-What-are-two-things-a-good-investment-might-do-A-good-investment-can-either/

- https://www.investopedia.com/terms/s/socialresponsibility.asp

- https://www.linkedin.com/pulse/how-corporate-social-responsibility-helps-countrys-economy-sheorain

- https://en.wikipedia.org/wiki/Socially_responsible_investing

- https://www.sciencedirect.com/topics/social-sciences/socially-responsible-investment

- https://www.investopedia.com/terms/l/liquidasset.asp

- https://www.fortunebuilders.com/investment-strategies-to-get-started/

- https://portfolioslab.com/lazy-portfolios

- https://www.carboncollective.co/sustainable-investing/socially-responsible-portfolio

- https://www.linkedin.com/pulse/what-3-second-bitcoin-flip-trade-jeff-clark-stocksreviewed-cjzve

- https://www.techtarget.com/searchcio/definition/corporate-social-responsibility-CSR

- https://www.goodfinance.org.uk/understanding-social-investment

- https://www.indeed.com/career-advice/career-development/social-responsibility

- https://www.forbes.com/advisor/investing/esg-investing/

- https://commdev.org/wp-content/uploads/pdf/publications/Measuring-Value-A-Guide-to-Social-Return-on-Investment.pdf

- https://www.nibusinessinfo.co.uk/content/what-corporate-social-responsibility

- https://study.com/academy/lesson/investment-strategy-definition-types.html

- https://www.investopedia.com/articles/markets/121515/8-high-risk-investments-could-double-your-money.asp

- https://www.investopedia.com/articles/basics/13/portfolio-growth-strategies.asp

- https://www.mycnote.com/blog/what-you-need-to-know-about-social-investment/

- https://benevity.com/resources/types-of-corporate-social-responsibility

- https://www.investopedia.com/terms/c/corp-social-responsibility.asp

- https://www.lehnerinvestments.com/en/traits-of-good-investment-opportunity-long-term-success/

- https://www.bogleheads.org/wiki/Three-fund_portfolio

- https://www.markercontent.com/articles/lifestyle/the-7030-rule-of-investing-and-managing-money-229413

- https://www.goodfinance.org.uk/understanding-social-investment/types-social-investment

- https://www.deborahmacdonald.com/how-to-spot-a-bad-investment-and-a-good-one-from-a-mile-away/

- https://pwonlyias.com/mains-answer-writing/corporate-social-responsibility-makes-companies-more-profitable-and-sustainable-analyse-150-words-10-marks/

- https://www.investopedia.com/ask/answers/032415/which-investments-have-highest-historical-returns.asp

- https://www.socialinnovationacademy.eu/project/social-investment-definition/

- https://www.bankrate.com/investing/investment-strategies-for-beginners/

- https://www.cooleaf.com/guides/making-an-impact-the-benefits-of-corporate-social-responsibility-csr

- https://www.fidelity.com/viewpoints/retirement/successful-saving

- https://www.investors.com/how-to-invest/investors-corner/sell-a-stock-cutting-losses-short-is-first-rule/

- https://www.finra.org/investors/investing/investment-products/stocks

- https://www.unpri.org/introductory-guides-to-responsible-investment/what-is-responsible-investment/4780.article

- https://www.nerdwallet.com/article/investing/socially-responsible-investing

- https://www.mdpi.com/2071-1050/14/2/909

- https://www.linkedin.com/pulse/impact-corporate-social-responsibility-business-success

- https://www.financestrategists.com/wealth-management/esg/socially-responsible-investing-sri/

- https://www.moomoo.com/us/learn/detail-what-is-socially-responsible-investment-sri-84747-221183144

- https://www.mdos.si/wp-content/uploads/2018/04/defining-corporate-social-responsibility.pdf

- https://www.nordea.com/en/news/what-is-esg

- https://financeunlocked.com/discover/glossary/level-1,-2,-and-3-assets-valuation

- https://www.marketwatch.com/picks/this-is-warren-buffetts-first-rule-about-investing-heres-what-to-do-if-your-financial-adviser-breaks-that-rule-01635799738

- https://www.apiday.com/blog-posts/what-are-the-differences-between-corporate-social-responsibility-csr-and-environmental-social-governance-esg

- https://www.linkedin.com/pulse/what-role-social-investing-greenarc-capital

- https://www.robeco.com/en-uk/glossary/sustainable-investing/best-in-class

- https://www.dss.gov.au/communities-and-vulnerable-people-programs-services/social-impact-investing

- https://pyinvesting.com/blog/14/top-3-factors-that-determine-which-investment-strategy-is-right-for-you/

- https://www.nsw.gov.au/osii/social-impact-investments

- https://www.sec.gov/investor/pubs/tenthingstoconsider.htm

- https://fastercapital.com/content/Socially-Responsible-Investing--Making-a-Positive-Impact-in-Communities.html

- https://www.linkedin.com/pulse/impact-corporate-social-responsibility-sustainable-dr-

- https://www.nerdwallet.com/article/investing/the-best-investments-right-now

- https://www.investopedia.com/terms/i/investing.asp

- https://www.investopedia.com/ask/answers/041015/why-social-responsibility-important-business.asp

- https://scholarship.law.bu.edu/faculty_scholarship/3664/

- https://www.ussif.org/performance

- https://www.tandfonline.com/doi/full/10.1080/1331677X.2018.1547202

- https://www.moneycontrol.com/news/mcminis/what-are-stage-3-assets-in-nbfc-10110951.html