What is the rule 406 of the Securities Act of 1933?

Section 406, which directs us to adopt rules requiring a company to disclose whether it has adopted a code of ethics for its senior financial officers, and if not, the reasons therefor, as well as any changes to, or waiver of any provision of, that code of ethics.

Securities Act Rule 406[1] and Exchange Act Rule 24b-2[2] provide the exclusive means for companies to object to the public release of confidential information that is otherwise required to be filed.

Accordingly, under Rule 406 of the Securities Act of 1933 and Rule 24b-2 of the Securities Exchange Act of 1934, the SEC permits public companies to request confidential treatment of certain information contained in these exhibits—meaning a company may redact the sensitive information and shield it from public view.

Under clause (2) of the definition of ineligible issuer in Rule 405 of the Securities Act, an issuer shall not be an ineligible issuer if the Commission determines, upon a showing of good cause, that it is not necessary under the circ*mstances that the issuer be considered an ineligible issuer.

Confidential Treatment Requests

SEC Rule 83 (17 CFR 200.83) provides a confidential treatment procedure for those submitting information to the agency to ask that it be withheld when requested under the Freedom of Information Act.

Exempt transactions are securities transactions that are exempt from the registration requirements of the 1933 Securities Act. Four typical examples of transaction exemptions in the United States include 1) Regulation A Offerings, 2) Regulation D Offerings, 3) Intrastate Offerings, and 4) Rule 144 Offerings.

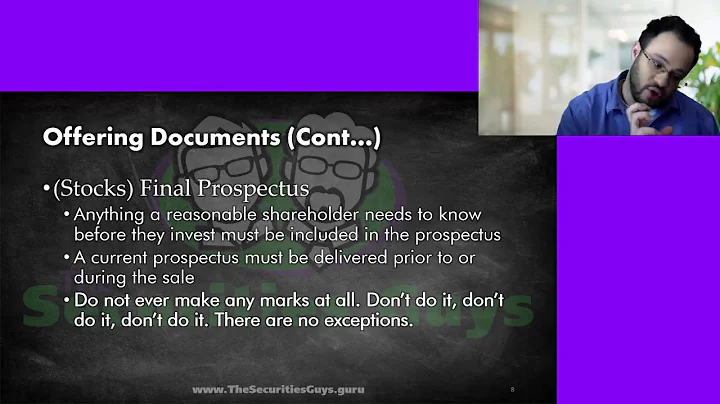

SEC Form 424B4 is the prospectus form that a company must file to disclose information they refer to in SEC Forms 424B1 and 424B3. Rule 424(b)(4) of the Securities Act of 1933 stipulates this.

Section 17(b) of the Securities Act makes it unlawful for any person to tout a stock without disclosing the nature and substance of any consideration, whether present or future, direct or indirect, received from an issuer, underwriter or dealer.

Section 17(b) of the Securities Act of 1933 ("the Securities Act") mandates that if a person is paid by an issuer to promote a security, the person must disclose the nature, source and amount of such compensation.

Rule 12b-25 requires a company that is not filing a Form 10-K or Form 10-Q by its prescribed due date to file a Form 12b-25 within one business day after that prescribed due date.

What is Rule 147 of the Securities Act of 1933?

Rule 147 is considered a “safe harbor” under Section 3(a)(11), providing objective standards that a company can rely on to meet the requirements of that exemption. Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities.

Requirements of Rule 506

The issuer must provide the non-accredited investors with certain disclosures, such as financial statements and be available to answer questions from non-accredited investors.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Under Rule 83, the submitter of information must mark each page with "Confidential Treatment Requested by [name]" and an identifying number and code, such as Bates-stamped number. The words "FOIA Confidential Treatment Request" must appear on the top of the first page of the request.

Rule 83 generally requires the submission of the information covered by the CTR separately from that for which confidential treatment is not requested, appropriately marked as confidential, and accompanied by a separate written request in paper format for confidential treatment.

The current version of Rule 83 generally requires all records which contain information for which a request for confidential treatment is made or the appropriate segregable portion thereof to be "marked by the person submitting the records with a prominent stamp, typed legend, or other suitable form of notice on each ...

Rule 501(a) of Reg D of the '33 Act defines how a person or entity can qualify as an accredited investor—a requirement for purchasing some unregistered securities.

Explanation: The United States Securities Act of 1933, often termed the '33 Act', considers limited partnership interests, bonds, and subchapter S corporate stock as securities. However, it does not categorize a pension fund as a security.

Rule 477 (17 CFR 230.477) under the Securities Act of 1933 (15 U.S.C. 77a et seq.) sets forth procedures for withdrawing a registration statement, including any amendments or exhibits to the registration statement.

Rule 488 — Effective date of registration statements relating to securities to be issued in certain business combination transactions. Rule 489 — Filing of form by foreign banks and insurance companies and certain of their holding companies and finance subsidiaries.

What is the rule 485 of the Securities Act of 1933?

Rule 485(a) of the Securities Act of 1933 says that a post-effective amendment filed by a registered open-end management investment company or unit investment trust shall become effective on the 60th day after the filing.

To claim the Rule 169 safe harbor certain conditions must be satisfied: (1) the issuer has previously released information of the type in the ordinary course of its business; (2) the timing, manner, and form in which the information is released is consistent in material respects with similar past releases; (3) the ...

Rule 138 — Publications or distributions of research reports by brokers or dealers about securities other than those they are distributing.

As previously mentioned, SEC Rule 145 focuses on mergers, acquisitions, consolidations, and reclassifications of assets because these actions impact investment decisions. The rule is based on whether the securities holder has to vote on the exchange of existing securities for securities in another company.

As adopted, Rule 801 requires that the offeror be a foreign private issuer. It does not impose any other offeror eligibility requirements. Where U.S. participation is only incidental to the offering, no other offeror eligibility criteria are necessary. Investors are already familiar with the issuer and the security.

References

- https://www.sifma.org/wp-content/uploads/2018/02/Amended-Rule-105-of-Regulation-M-FAQs.pdf

- https://www.investopedia.com/terms/s/shortswingprofitrule.asp

- https://www.law.cornell.edu/wex/blue_sky_law

- https://mastercompliance.com/2022/01/rule-147-offerings/

- https://www.publicchatter.com/2022/06/4-reasons-why-you-dont-want-to-be-deemed-an-executive-officer/

- https://www.securitieswhistleblowerattorneys.com/common-securities-violations.html

- https://www.sec.gov/rules/1999/02/rule-701exempt-offerings-pursuant-compensatory-arrangements

- https://www.federalregister.gov/documents/2023/03/16/2023-05377/submission-for-omb-review-comment-request-extension-securities-act-rule-477

- https://www.investopedia.com/terms/s/sec-form-n-14ae.asp

- https://www.whitecase.com/insight-alert/sec-continues-prove-it-most-powerful-influencer-how-avoid-touting-charges

- https://www.sec.gov/divisions/investment/noaction/2018/pimco-corporate-091318-486b.htm

- https://www.sec.gov/enforce/34-99578-s

- https://www.merriam-webster.com/dictionary/bona%20fide

- https://content.next.westlaw.com/practical-law/document/Ic98cd3a71f1011ed9f24ec7b211d8087/Section-16-Toolkit?viewType=FullText&transitionType=Default&contextData=(sc.Default)

- https://www.rule144solution.com/faq/

- https://www.afslaw.com/perspectives/alerts/crypto-anti-touting-lawsuits-celebrity-settlements-sec-following-alleged

- https://www.investor.gov/introduction-investing/investing-basics/glossary/no-action-letters

- https://www.irishstatutebook.ie/eli/2014/act/38/section/105/enacted/en/html

- https://www.sec.gov/education/capitalraising/building-blocks/sec-have-do-my-private-company

- https://www.investopedia.com/terms/s/sec-form-424b4.asp

- https://brainly.com/question/36451084

- https://www.sec.gov/education/smallbusiness/exemptofferings/faq

- https://www.sec.gov/foia/conftreat

- https://www.sec.gov/interps/telephone/cftelinterps_sec16.pdf

- https://www.law.cornell.edu/cfr/text/17/230.405

- https://hedgefundlawblog.com/token-distribution-and-unregistered-restricted-securities.html

- https://www.investopedia.com/terms/u/unregistered-shares.asp

- https://www.dwilawyerstexas.com/what-crimes-should-be-reported-to-finra/

- https://www.quora.com/How-long-is-5-business-days

- https://lawblogs.uc.edu/sld/the-deskbook-table-of-contents/the-securities-acts-statutory-law/the-securities-act-of-1933/regulations-adopted-under-the-securities-act-of-1933/regulation-c-registration-rule-400-to-rule-498/

- https://www.forkeylaw.com/unregistered-securities-offering-red-flags.html

- https://www.torys.com/our-latest-thinking/publications/2023/10/us-congress-may-eliminate-section-16-exemption-for-foreign-private-issuers

- https://www.vocabulary.com/dictionary/affiliation

- https://www.sec.gov/corpfin/confidential-treatment-applications.htm

- https://www.sec.gov/Archives/edgar/data/1509957/000151116416000890/filename42.htm

- https://www.investopedia.com/ask/answers/06/subsidiaries.asp

- https://www.dfinsolutions.com/knowledge-hub/thought-leadership/knowledge-resources/what-is-section-16-filing

- https://www.perkinscoie.com/en/pch-chapter-15.html

- https://www.bloomberglaw.com/external/document/X3IJN0S4000000/finance-comparison-table-types-of-rule-424-prospectuses

- https://www.pillsburylaw.com/images/content/4/8/v2/483/RobbinsRule7012013.pdf

- https://www.hourly.io/post/how-long-is-a-business-day

- https://btlaw.com/insights/alerts/2023/rule-105-revisited-sec-actions-remind-private-fund-managers-about-participating-in-offering

- https://www.quora.com/Are-affiliates-considered-employees

- https://content.next.westlaw.com/practical-law/document/Ibb0a1321ef0511e28578f7ccc38dcbee/Well-Known-Seasoned-Issuer-WKSI?viewType=FullText&transitionType=Default&contextData=(sc.Default)

- https://www.law.cornell.edu/uscode/text/15/77fff

- https://www.titan.com/articles/accredited-investor-rule-501

- https://invest-faq.com/selling-unregistered-securities/

- https://www.upcounsel.com/rule-145

- https://www.ssm.com.my/acts/fscommand/act125s0105.htm

- https://www.finra.org/rules-guidance/rulebooks/retired-rules/rule-134

- https://www.sec.gov/Archives/edgar/data/354260/000107878211003415/filename1.htm

- https://en.wikipedia.org/wiki/Blue_sky_law

- https://www.finowings.com/Corporate-Scams/what-is-a-shell-company

- https://www.law.cornell.edu/cfr/text/17/240.16a-1

- https://tapfiliate.com/blog/affiliate-vs-subsidiary/

- https://www.wowlw.com/Article/Index/143

- https://www.century21.com/glossary/definition/bona-fide

- https://www.ppsr.gov.au/about-us/about-ppsr

- https://www.sec.gov/divisionsmarketregtmcomplianceregmrule105-secg.htm

- https://www.mclaughlinpc.com/theme/assets/pdfs/Unregistered-Securities%20Offerings.pdf

- https://www.finra.org/filing-reporting/regulatory-filing-systems/rule-4530-reporting-requirements

- https://www.investopedia.com/ask/answers/08/unregistered-securities.asp

- https://www.law.cornell.edu/cfr/text/17/210.1-02

- https://www.finra.org/rules-guidance/key-topics/private-placements/filing-guidance

- https://www.concord.app/template-center/bona-fide-offer-to-purchase-assets/

- https://www.17a-4.com/rules-and-regulations-sec-finra-doj-cftc/

- https://ccrcorp.com/section16/

- https://www.investopedia.com/articles/fundamental-analysis/08/sec-forms.asp

- https://www.gannons.co.uk/insolvency-restructuring/share-buyback/

- https://www.sec.gov/files/rules/other/2020/33-10898.pdf

- https://www.federalregister.gov/documents/2023/10/04/2023-21924/proposed-collection-comment-request-extension-rule-173

- https://quizlet.com/537328458/worksheet-302-securities-exchange-act-of-1934-flash-cards/

- https://www.genieai.co/define/section-16-officer

- https://www.sec.gov/interps/telephone/cftelinterps_securitiesactrules.pdf

- https://www.investopedia.com/terms/c/cusipnumber.asp

- https://www.investopedia.com/terms/s/schedule13d.asp

- https://www.wilmerhale.com/en/insights/blogs/keeping-current-disclosure-and-governance-developments/20230828-recent-sec-enforcement-activity-serves-as-a-reminder-that-rule-12b-25-requires-substantive-disclosures

- https://www.law.cornell.edu/wex/rule_506

- https://www.sec.gov/rules/1999/10/cross-border-tender-and-exchange-offers-business-combinations-and-rights-offerings

- https://www.sec.gov/whistleblower/submit-a-tip

- https://www.sec.gov/Archives/edgar/data/1449447/000139390512000359/filename1.htm

- https://www.law.cornell.edu/wex/well-known_seasoned_issuer_(wksi)

- https://www.investopedia.com/terms/n/non-security.asp

- https://www.securitieslawyer101.com/wp-content/uploads/2014/12/Short-Swing-Profits-Q-A.pdf

- https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=2124&context=nlr

- https://www.sec.gov/Archives/edgar/data/704384/000119312504051976/dex995.htm

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/types-of-security/

- https://www.sec.gov/investor/pubs/regsho.htm

- https://www.investopedia.com/terms/i/investment-securities.asp

- https://corpgov.law.harvard.edu/2017/03/01/section-16b-if-at-first-you-dont-succeed/

- https://www.sec.gov/page/OpportunityZones.pdf

- https://www.investor.gov/protect-your-investments/fraud/resources-victims-securities-law-violations

- https://qz.com/taylor-swift-question-ftx-crypto-securities-collapse-1850351886

- https://www.bloomberglaw.com/external/document/XDPL2R04000000/capital-markets-comparison-table-types-of-securities-act-of-1933

- https://www.finra.org/investors/insights/know-the-facts-direct-registered-shares

- https://www.winston.com/en/legal-glossary/what-is-the-securities-exchange-act-of-1934

- https://www.investopedia.com/terms/s/seact1934.asp

- https://www.dechert.com/knowledge/onpoint/2023/9/sec-adopts-amendments-to-fund--names-rule--.html

- https://www.finra.org/rules-guidance/rulebooks/retired-rules/rule-430-0

- https://www.meridiancp.com/wp-content/uploads/Section-16b-Insider-Trading-Rules.pdf

- https://www.innreg.com/blog/hiring-practices-background-check-requirements-finra-rule-3110e

- https://www.investopedia.com/terms/s/sec-form-485-a24e.asp

- https://www.nasaa.org/industry-resources/uniform-securities-acts/

- https://www.nirmalbang.com/knowledge-center/benefits-of-investing-in-stocks.html

- https://content.next.westlaw.com/practical-law/document/Ibb0a1358ef0511e28578f7ccc38dcbee/Shell-Company?viewType=FullText&transitionType=Default&contextData=(sc.Default)

- https://www.investopedia.com/terms/a/affiliatedcompanies.asp

- https://www.law.cornell.edu/wex/securities_act_of_1933

- https://www.federalreserve.gov/supervisionreg/topics/securities.htm

- https://www.upcounsel.com/how-many-shares-can-i-buy-maximum

- https://www.sec.gov/rules/2000/09/amendments-commissions-freedom-information-and-privacy-act-rules-and-confidential

- https://www.sec.gov/litigation/admin/33-7885

- https://www.willkie.com/publications/2007/12/sec-eases-requirements-of-rules-144-and-145-rega__

- https://federal-lawyer.com/understanding-sec-investigations/

- https://www.sec.gov/foia-services

- https://www.investopedia.com/terms/r/secrule147.asp

- https://secwhistlebloweradvocate.com/how-sec-investigations-work/

- https://lawblogs.uc.edu/sld/the-deskbook-table-of-contents/the-securities-acts-statutory-law/the-securities-act-of-1933/regulations-adopted-under-the-securities-act-of-1933/regulation-a-r-special-exemptions-rule-236-to-rule-239t-2/

- https://tyracpa.com/unregistered-securities/

- https://www.finra.org/sites/default/files/Industry/p119095.pdf

- https://study.com/academy/lesson/overview-of-sec-rule-145.html

- https://www.investopedia.com/terms/s/security.asp

- https://www.wakeforestlawreview.com/2023/04/silent-treatment-the-increase-in-confidential-treatment-redactions-in-sec-filings/

- https://www.sec.gov/education/smallbusiness/exemptofferings/intrastateofferings

- https://www.federalregister.gov/documents/2023/10/04/2023-21927/proposed-collection-comment-request-extension-rule-425

- https://www.sec.gov/rules/2003/11/purchases-certain-equity-securities-issuer-and-others

- https://www.srz.com/images/content/6/8/v2/68553/SRZ-Trading-and-Compliance-Issues-Under-Rule-105-White-Paper.pdf

- https://lexcomply.com/rsjadmin/news/202303313435Booklet-%20Implement%20Guide%20on%20Reporting%20under%20Companies%20(Audit%20and%20Auditors)%20Rules,%202014.pdf

- https://www.federalcriminallawyer.us/securities-fraud/

- https://www.investor.gov/introduction-investing/investing-basics/glossary/securities-act-rule-144

- https://www.bclplaw.com/en-US/events-insights-news/sec-staff-announces-temporary-procedures-for-supplemental-materials-and-rule-83-confidential-treatment-requests.html

- https://www.sec.gov/education/smallbusiness/goingpublic/exchangeactreporting

- https://thelawdictionary.org/affiliate/

- https://www.paulhastings.com/insights/client-alerts/sec-reporting-obligations-under-section-13-and-section-16-of-the-exchange

- https://dart.deloitte.com/USDART/home/accounting/sec/rules-regulations/240-securities-exchange-act-1934-rules/a-rules-regulations-under-securities-exchange/240-16b-exemption-certain-transactions-from

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/exempt-transaction/

- https://www.lw.com/admin/upload/SiteAttachments/Good%20the%20bad%20and%20the%20offer%20how-to-navigate-publicity-and-offers-of-securities.pdf

- https://www.sec.gov/about/offices/ocie/risk-alert-091713-rule105-regm.pdf